Several market development initiatives are promising to boost the availability of both private equity and venture capital market in CroatiaThis year has witnessed the launch of the first Croatian venture capital fund with EUR 42 million available for investing in early stage and startup companies by providing both financing and expertise need to support promising entrepreneurial ideas and develop those in scalable and viable commercial ventures. Next year, five new private equity funds are expected to come to the market with total of EUR 235 million.

What is private equity and venture capital?

Private equity is provision of long-term investment in companies in exchange of ownership interest (equity). Private equity fund managers are specialists with knowledge of building a better business. The objective is to provide a transformational change in the company usually by making companies bigger, better and stronger. Sometimes, private equity provides much needed patient (long-term) capital to provide turnaround opportunities and rescue business operations burdened with too much debt. Private equity partners do not provide only financing, but also skills, acumen and network of contacts (industry specialists, strategic investors and other financiers) to improve business operations, strengthen management and expand into new markets. Private equity fund managers raise funds from range of provides including institutional investors (pension funds, insurance companies), as well as private high net worth individuals. In our CEE region, usually a recognized international financing institution such as EIF or EBRD is a cornerstone investor.

Venture capital is a subset of private equity investment focusing on startup companies. Venture capital investors support entrepreneurs with bright ideas but need both finance and expertise to develop their businesses into scalable and commercially viable operations.

Short history of Croatian private equity funds

Private equity funds have long dated history with Croatia. The first generation of local funds started back in 1997 with two internationally backed initiatives (SEAF Croatia and Coperinucs Adriatic). Further on, two first time fund management teams formed private equity funds with local institutional investors in 2005 (Quaestus) and 2008 (Nexus). However, the market remained embryonic before the Croatian Government launched the initiative called the Economic Cooperation Funds (FGS) to support development of private equity and venture capital market in Croatia. The FGS initiative consisted of direct intervention to boost the availability of financing for growth and restructuring capital (private equity). Croatian Government, as public investor, invested on pari passu terms with private investors to qualifying private equity and venture capital funds. Under the FGS initiative, five new private equity funds became operational since 2011 (February – April), including Alternative FGS, Honestas FGS, Nexus FGS, Prosperus FGS and Quaestus Private Equity Fund II. The private equity / venture capital funds jointly raised commitments from both public and private sector amounting to the maximum amount of the programme HRK 2 billion (EUR 268 million).

Croatian private equity investment in numbers

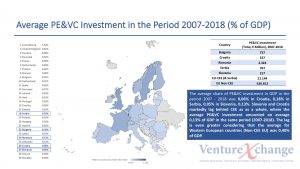

Croatia is lagging behind its regional peers and other EU members in attracting private equity investment. Average private equity investment in the period 2007 – 2018 per annum was 0.06% of GDP for Croatia, while the average private equity investment in the same period for the CEE EU member countries and Serbia was 0.13%. Western European (Non-CEE) EU member countries in the same period attracted on average 0.40% of GDP private equity investment per annum. Total private equity investment in the period 2007 – 2018 amounted to EUR 327 million which was invested in total number of 59 transactions, including the follow-on investments in the same companies.

Past data show great volatility of private equity investments in Croatia ranging from EUR 7,2 million in 2007 (0,02% of GDP) to EUR 76,7 million in 2018 (0,15% of GDP). However, increase in private equity investment is not linear, but shows great volatility from year-to-year which can be explained to very few large buyout transactions.

In 2018, Enterprise Investors made two direct acquisitions in the Croatian market in 2018 investing in Studenac (100% ownership stake) and Pan-Pek (65% ownership stake) with total equity investment in those two transactions exceeding EUR 67,2 million.

In April 2019, Mid Europa has made investment in Mlinar for the equity consideration of EUR 75 million. Total private equity investment in the first half of 2019 amounted to EUR 78 million (0,16% of GDP) comprising of 3 venture capital transactions, 1 growth capital transaction and 1 buyout.

New wave of Croatian private equity funds coming to the market in 2020

In 2020, there will be five new private equity funds coming to the market.

First, we expect two-to-three fund to be supported by the Croatian Growth Investment Programme (CROGIP). EIF is managing the process and is currently contacting due diligence and selecting the private equity fund managers. Under the CROGIP, public investment will be funded by both EIF and HBOR and private equity fund managers will need to also fundraise funds from private investors. The objective of CROGIP is to support Croatian SMEs, small midcap and midcaps, to attract private equity investment to Croatia and to build local capacity by supporting fund managers which focus a significant part of their investments into Croatian companies.

Second, two new funds are expected to become operational at the beginning of 2020 with headquarters in Zagreb, Croatia, including Invera Equity and Feels Good Capital.

Invera Equity set up by IMAP partners (formerly Ascendant Capital Advisors) is expected to be launched in Q1 2020. The fund focus will be regional buy-and-built consolidation opportunities in sectors including food and beverages, manufacturing and industrials, information and communication technologies, services (including healthcare and transportation) and hospitality. The fund will target a diversified portfolio with a typical investment size of EUR 4-12 million. The countries in focus include Croatia, Slovenia, Bosnia & Herzegovina, Serbia and Montenegro.

Feels Good Capital is expected to be launched in Q1 2020 for investing in Croatian and Slovenian companies providing growth capital with objective to make measurable impact by contributing to one or more of the 17 United Nations’ sustainable goals and delivering measurable social and/or environmental impact with profitable returns to their investors.

Venture capital markets development

The venture capital market developed impressively over the period of the past five years. Several Croatian companies have received venture-capital funding, albeit most at the cost of relocating their headquarters to one of the investors’ friendlier and more recognized jurisdictions (such as England, California, New York, Ireland or other). Not all of the companies pursued that strategies, with some remaining with headquarters in Croatia. Rimac Automobili was certainly the most successful Croatian company receiving several rounds of venture capital funding summing up to USD 125,9 million. In 2014, the company closed its Series A-founding amounting to EUR 10 million by raising funds from three investors including Frank Kanayet Yepes, Tek Cheung Yam through his company Integrated Asset Management Asia Limited (IAMAL) and China Dynamics. The company has received total of six financing rounds with the latest comprising of corporate venture capital from Porche (2018, 2019) and Hyundai Motor Company (2019) and Kia Motors (2019).

In 2015, South Central Ventures was launched having received the funding under the closed call procedure managed by EIF under the Enterprise Innovation Fund (ENIF) programme (part of Western Balkans Enterprise Development & Innovation Facility (WBEDIF). South Central Ventures was established by partners of Slovenian venture capital fund RSG Capital and has regional focus with Croatian investments playing an important part. The partners have fundraised EUR 40 million and have since 2015 invested in 38 companies with median round amounting to USD 0,81 million. Their portfolio currently comprises of 29 companies with 3 realized exits with median valuations amounting to USD 7,65 million.

In April 2019, Fill Rouge Capital II was launched under the Croatian Venture Capital Initiative (CVCi) fundraising total of EUR 42 million, including EUR 32,5 million from EIF under CVCi. The fund aims to run until the end of 2023 with plans to invest in up to 250 companies operating in Croatia by providing seed capital through the startup school, early stage capital through accelerator program and venture capital investment for funding-ready startups with funding.